Your Trusted Partner for Comprehensive Tax Services

Navigate your taxes with confidence. Our expert team provides comprehensive tax preparation, thorough tax audits, strategic tax planning, and seamless tax extensions. Let us handle the complexities, so you can focus on what matters most.

ABOUT US

At Big City Financial Solutions, we pride ourselves on being more than just tax professionals. We are dedicated partners committed to guiding you through every aspect of your tax journey. With years of experience and a team of certified experts, we offer a full spectrum of services including tax preparation, tax audits, tax planning, and tax extensions.

Our mission is to provide personalized, reliable, and transparent tax solutions tailored to meet your unique needs. We understand that every client's situation is different, and we approach each case with the attention and dedication it deserves.

our services

Expert Tax Preparation Services

Ensure your taxes are filed accurately and on time with our professional tax preparation services. Our experienced team meticulously handles every detail, maximizing your deductions and minimizing your liabilities. Let us take the stress out of tax season, so you can focus on what truly matters.

Comprehensive Tax Audit Support

Facing a tax audit can be daunting, but you don’t have to go through it alone. Our expert auditors provide thorough representation and support, ensuring you understand every step of the process. We work diligently to resolve any issues and protect your financial interests, giving you peace of mind during an otherwise stressful time.

Strategic Tax Planning Solutions

Achieve your financial goals with our strategic tax planning services. Our team of experts collaborates with you to develop personalized tax strategies that optimize your financial situation. We help you navigate the complexities of tax laws, ensuring you make informed decisions that benefit your financial future.

Hassle-Free Tax Extension Services

Need more time to file your taxes? We’ve got you covered. Our hassle-free tax extension services ensure you meet all IRS requirements, giving you the extra time you need to prepare. Trust us to handle the paperwork efficiently and accurately, so you can avoid penalties and focus on completing your tax return.

What Our Clients Are Saying

Discover why our clients trust us with their tax needs year after year. From individuals to businesses, our personalized and professional approach has made a lasting impact. Read their stories and see how Big City Financial Solutions has helped them navigate the complexities of taxes with ease and confidence. Your success is our success.

Choosing Big City Financial Solutions for my tax needs was a game-changer for my small business. The team's expertise in handling complex tax situations made a significant difference in my return and ensuring tax compliance.

Aleshia T.

I used to dread tax season, but that all changed when I found Big City Financial Solutions. Their user-friendly app, and their team went above and beyond to answer my questions promptly. They found deductions I would've never know about.

Martice C.

I've been entrusting my tax needs to Big City Financial Solutions for years, and they continue to impress me with their expertise in tax preparation.

They will always have a client in me!

Lakaria J.

FAQS

How can I file my taxes with Big City Financial Solutions?

Filing your taxes with Big City Financial Solutions is easy and convenient. Simply visit our website and create an account if you haven't already. From there, you can access our user-friendly online platform, where you'll be guided through the tax filing process step by step. Our platform is designed to make it as straightforward as possible, and if you ever have questions or need assistance, our expert team is just a message or a phone call away. We're here to support you throughout the entire process.

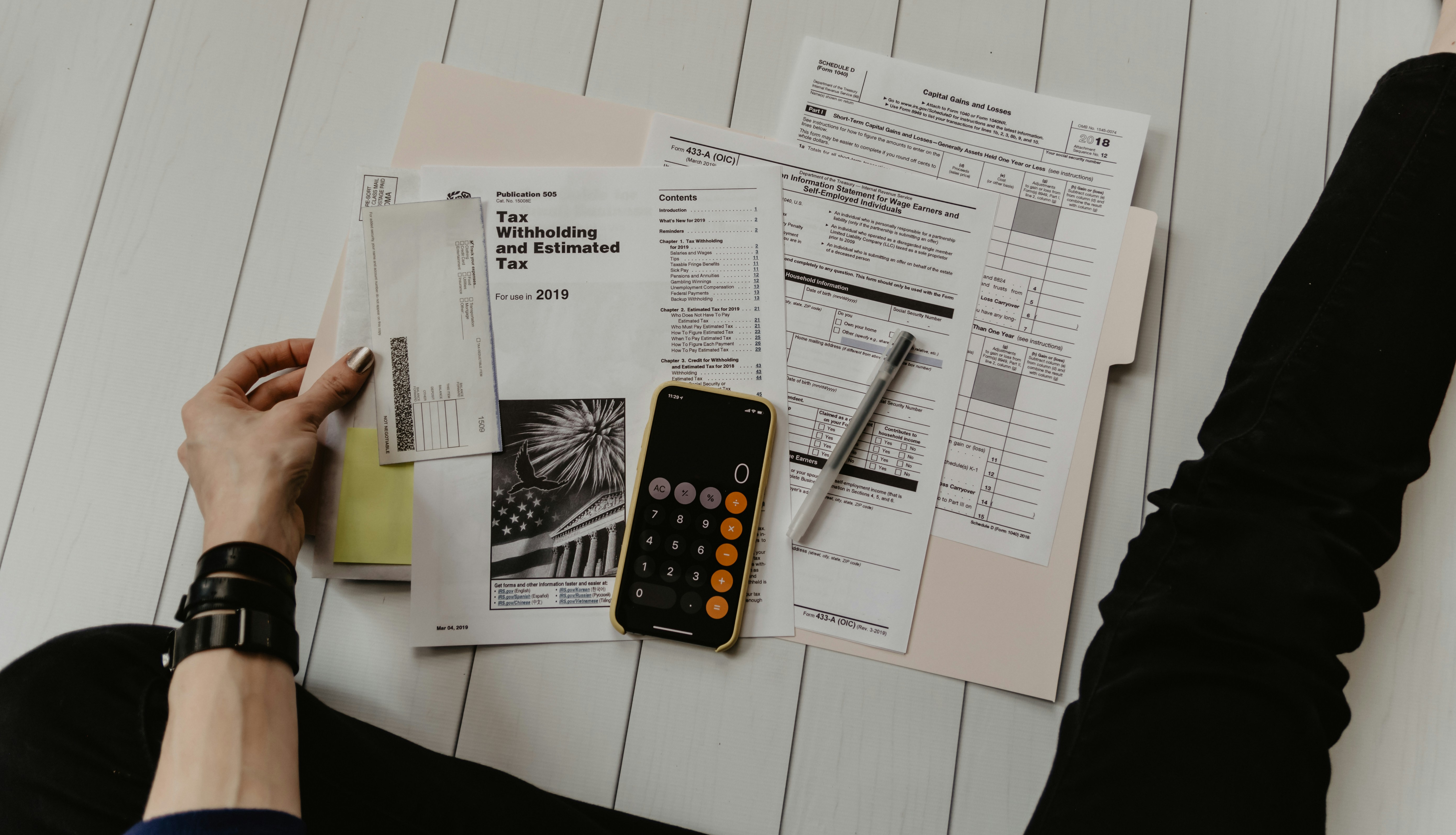

What documents do I need to provide for tax preparation?

To prepare your taxes accurately, we need various documents, including W-2s, 1099s, receipts for deductible expenses, mortgage interest statements, and records of other income or investments. Please also bring your previous year's tax return for reference.

How can I be sure my tax return is accurate?

Our team of experienced professionals follows meticulous procedures to ensure accuracy. We stay updated with the latest tax laws and double-check every return. Additionally, our services include a review process to catch any potential errors before submission.

What should I do if I receive a tax audit notice?

If you receive a tax audit notice, contact us immediately. Our experts will guide you through the process, help you understand the notice, and represent you during the audit to ensure your interests are protected.

How can tax planning benefit me or my business?

Tax planning helps you make informed financial decisions throughout the year, potentially reducing your tax liability and maximizing savings. Our personalized tax planning services ensure that you take advantage of all available deductions, credits, and strategies tailored to your unique situation.

Can you help me if I need an extension to file my taxes?

Absolutely. We offer hassle-free tax extension services to ensure you meet IRS deadlines. We handle all the necessary paperwork and submit your extension request, giving you extra time to prepare your tax return accurately and avoid penalties.

OUR TEAM

Our success is driven by the exceptional individuals who make up our dedicated team. We take pride in our diverse group of experts, each bringing a unique set of skills and a shared commitment to helping you navigate the complex world of taxes and finance.

Our team is comprised of seasoned tax professionals, certified accountants, and financial advisors, all with a deep understanding of tax regulations, financial planning, and investment strategies. We believe in continuous learning and staying up-to-date with the latest industry trends to provide you with the most accurate and current advice.